In today’s fast-paced world, unexpected expenses can arise at any moment, leaving individuals in need of quick access to funds. Personal loans have become a popular financing option, providing individuals with the necessary liquidity to cover various expenses, such as medical bills, weddings, home renovations, or debt consolidation. Banks offer a wide range of personal loan products, each with its unique features, benefits, and terms. This article aims to provide an in-depth look at personal loan offers from banks, highlighting the key aspects, benefits, and factors to consider when applying for a personal loan.

Types of Personal Loans Offered by Banks

Banks offer various types of personal loans to cater to different needs and financial situations. Some of the most common types of personal loans include:

- Unsecured Personal Loans: These loans do not require collateral and are approved based on the borrower’s creditworthiness and income. Unsecured personal loans typically have higher interest rates and stricter eligibility criteria.

- Secured Personal Loans: These loans require collateral, such as a car or property, to secure the loan. Secured personal loans often have lower interest rates and more flexible repayment terms.

- Fixed-Rate Personal Loans: These loans have a fixed interest rate, which remains constant throughout the loan tenure. Fixed-rate personal loans provide predictability and stability, making it easier to budget and plan.

- Variable-Rate Personal Loans: These loans have a variable interest rate, which can change over time. Variable-rate personal loans may offer lower interest rates initially, but the rate can increase or decrease based on market conditions.

Benefits of Personal Loans from Banks

Personal loans from banks offer several benefits, including:

- Quick Access to Funds: Personal loans provide quick access to funds, allowing individuals to cover unexpected expenses or financial emergencies.

- Flexibility: Personal loans can be used for various purposes, such as debt consolidation, weddings, or home improvements.

- Competitive Interest Rates: Banks offer competitive interest rates, making personal loans an attractive financing option.

- Repayment Flexibility: Personal loans often have flexible repayment terms, allowing borrowers to choose a repayment schedule that suits their needs.

- No Collateral Required: Unsecured personal loans do not require collateral, making them an ideal option for individuals who do not have assets to pledge.

Eligibility Criteria for Personal Loans

To be eligible for a personal loan from a bank, individuals must meet certain criteria, including:

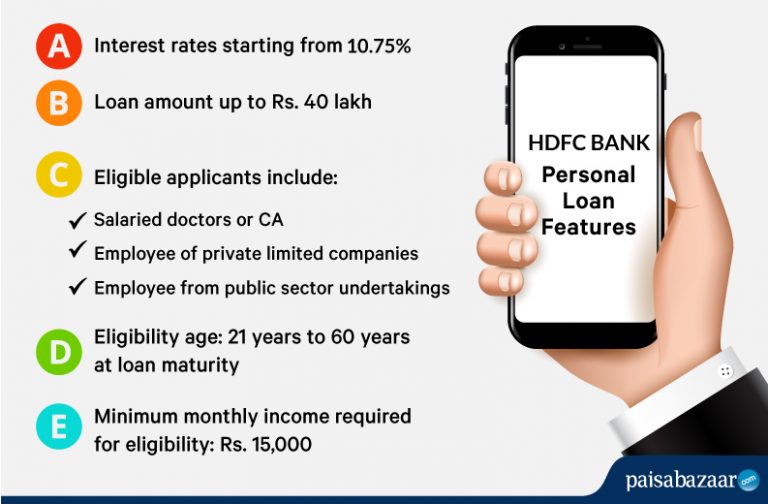

- Age: The borrower must be at least 21 years old and not more than 60 years old.

- Income: The borrower must have a stable income and a minimum salary requirement, which varies from bank to bank.

- Credit Score: A good credit score is essential to qualify for a personal loan. A credit score of 750 or higher is considered excellent.

- Employment History: The borrower must have a minimum of 2-3 years of work experience, depending on the bank’s requirements.

- Residency: The borrower must be a resident of the country where the bank operates.

Documentation Required for Personal Loans

To apply for a personal loan, individuals must submit the following documents:

- Identity Proof: Passport, driver’s license, or PAN card.

- Address Proof: Utility bills, rent agreement, or passport.

- Income Proof: Salary slips, Form 16, or income tax returns.

- Employment Proof: Letter from the employer or employment contract.

- Bank Statement: Recent bank statements to verify income and credit history.

How to Apply for a Personal Loan

Applying for a personal loan is a straightforward process, which can be completed online or offline. Here’s a step-by-step guide:

- Check Eligibility: Visit the bank’s website or branch to check the eligibility criteria and required documents.

- Choose a Loan Product: Select a personal loan product that suits your needs and financial situation.

- Submit Application: Submit the application form, along with the required documents, online or at a bank branch.

- Verification: The bank will verify the documents and credit history.

- Approval: The loan will be approved, and the amount will be disbursed to the borrower’s account.

Frequently Asked Questions (FAQs)

- What is the maximum loan amount I can borrow?

The maximum loan amount varies from bank to bank, but it typically ranges from Rs. 50,000 to Rs. 20 lakhs. - What is the interest rate on personal loans?

The interest rate on personal loans ranges from 10.50% to 24% per annum, depending on the bank and loan product. - Can I prepay my personal loan?

Yes, most banks allow prepayment of personal loans, but there may be prepayment charges applicable. - How long does it take to process a personal loan application?

The processing time for a personal loan application varies from bank to bank, but it typically takes 2-7 working days. - Can I apply for a personal loan with a bad credit score?

It is challenging to get a personal loan with a bad credit score, but some banks may consider applications with a higher interest rate or stricter repayment terms.

Conclusion

Personal loans from banks offer a convenient and flexible financing option for individuals to cover various expenses or financial emergencies. With competitive interest rates, flexible repayment terms, and minimal documentation, personal loans have become a popular choice among borrowers. However, it is essential to carefully evaluate the loan terms, interest rates, and repayment schedule before applying for a personal loan. By understanding the eligibility criteria, documentation requirements, and application process, individuals can make informed decisions and choose the best personal loan product that suits their needs and financial situation. Remember to always read the fine print, and don’t hesitate to reach out to the bank’s customer support team if you have any questions or concerns.

Closure

Thus, we hope this article has provided valuable insights into Personal Loan Offers from Banks: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!