In today’s fast-paced world, financial emergencies can arise at any moment, and having access to quick and easy funding can be a lifesaver. A personal loan with minimum documents is an attractive option for individuals who need immediate financial assistance without having to go through the hassle of lengthy documentation. In this article, we will delve into the world of personal loans with minimum documents, exploring the benefits, features, and requirements of such loans.

What is a Personal Loan with Minimum Documents?

A personal loan with minimum documents is a type of unsecured loan that requires minimal documentation and paperwork. These loans are designed to provide quick and easy access to funds, typically for individuals who need to cover unexpected expenses, such as medical bills, car repairs, or other financial emergencies. The primary advantage of a personal loan with minimum documents is that it eliminates the need for extensive documentation, making the loan application process faster and more convenient.

Benefits of Personal Loan with Minimum Documents

There are several benefits to opting for a personal loan with minimum documents, including:

- Quick Approval: Personal loans with minimum documents are typically approved quickly, often within a few hours or days, depending on the lender and the applicant’s eligibility.

- Minimal Paperwork: The documentation required for these loans is minimal, making the application process faster and more convenient.

- Unsecured Loan: Personal loans with minimum documents are unsecured, meaning that borrowers do not need to pledge any collateral or assets to secure the loan.

- Flexibility: These loans can be used for a variety of purposes, including covering unexpected expenses, consolidating debt, or financing a large purchase.

- Competitive Interest Rates: Many lenders offer competitive interest rates for personal loans with minimum documents, making them an attractive option for borrowers.

Features of Personal Loan with Minimum Documents

Some of the key features of personal loans with minimum documents include:

- Loan Amount: The loan amount offered can vary depending on the lender and the borrower’s eligibility, but it is typically in the range of ₹50,000 to ₹5 lakhs.

- Interest Rate: The interest rate charged on personal loans with minimum documents can vary between 11% to 24% per annum, depending on the lender and the borrower’s credit score.

- Repayment Tenure: The repayment tenure for these loans can range from 6 months to 5 years, depending on the lender and the borrower’s eligibility.

- Processing Fee: A processing fee is typically charged by lenders, which can range from 1% to 3% of the loan amount.

Requirements for Personal Loan with Minimum Documents

While the documentation required for personal loans with minimum documents is minimal, there are certain requirements that borrowers need to meet to be eligible for these loans. Some of the common requirements include:

- Age: The borrower must be at least 21 years old to be eligible for a personal loan with minimum documents.

- Income: The borrower must have a stable income, either as a salaried individual or as a self-employed individual, to be eligible for the loan.

- Credit Score: A good credit score is essential to be eligible for a personal loan with minimum documents. A credit score of 650 or higher is typically required by lenders.

- Identity Proof: The borrower must provide a valid identity proof, such as a passport, driving license, or PAN card.

- Address Proof: The borrower must provide a valid address proof, such as a utility bill or a lease agreement.

How to Apply for Personal Loan with Minimum Documents

Applying for a personal loan with minimum documents is a straightforward process that can be completed online or offline. Here are the steps to follow:

- Check Eligibility: Check your eligibility for a personal loan with minimum documents by visiting the lender’s website or by contacting their customer care.

- Choose a Lender: Choose a reputable lender that offers personal loans with minimum documents and competitive interest rates.

- Fill Application Form: Fill the application form, either online or offline, and provide the required documents.

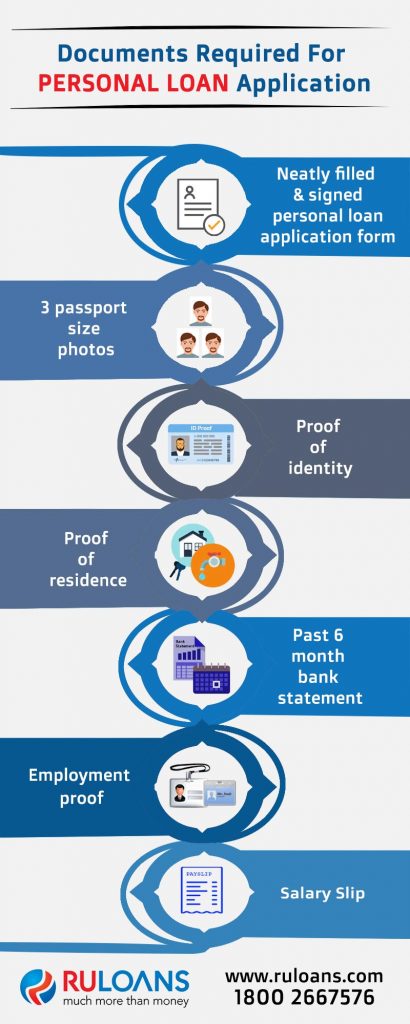

- Submit Documents: Submit the required documents, including identity proof, address proof, and income proof.

- Wait for Approval: Wait for the lender to approve your loan application, which can take a few hours or days, depending on the lender.

Frequently Asked Questions (FAQs)

- What is the minimum credit score required for a personal loan with minimum documents?

A good credit score is essential to be eligible for a personal loan with minimum documents. A credit score of 650 or higher is typically required by lenders. - What are the documents required for a personal loan with minimum documents?

The documents required for a personal loan with minimum documents include identity proof, address proof, and income proof. - Can I apply for a personal loan with minimum documents online?

Yes, you can apply for a personal loan with minimum documents online by visiting the lender’s website and filling the application form. - What is the maximum loan amount that can be borrowed under a personal loan with minimum documents?

The maximum loan amount that can be borrowed under a personal loan with minimum documents can vary depending on the lender and the borrower’s eligibility, but it is typically in the range of ₹50,000 to ₹5 lakhs. - What is the repayment tenure for a personal loan with minimum documents?

The repayment tenure for a personal loan with minimum documents can range from 6 months to 5 years, depending on the lender and the borrower’s eligibility.

Conclusion

A personal loan with minimum documents is an attractive option for individuals who need immediate financial assistance without having to go through the hassle of lengthy documentation. These loans offer quick approval, minimal paperwork, and competitive interest rates, making them an ideal solution for covering unexpected expenses or consolidating debt. However, borrowers must ensure that they meet the eligibility criteria and requirements set by lenders to be eligible for these loans. By understanding the benefits, features, and requirements of personal loans with minimum documents, borrowers can make informed decisions and choose the best loan option that suits their needs.

Closure

Thus, we hope this article has provided valuable insights into Personal Loan with Minimum Documents: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!